Table of Content

If she works 49 weeks of the year , she could claim a deduction on the rent cost of $4,900 per year. Individuals in either category mentioned above can claim depreciation of plant and equipment items such as desks, chairs and computers. ""Should not assets generated by a family business be utilized for the benefit of that family? If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation for that area. You need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and depreciation.

However the ATO introduced the method as a direct response to taxpayer’s changed work arrangements arising from COVID-19 and this is reflected in the limited applicable period of 1 March 2020 to 30 September 2020. These may include a record of the number of hours worked, a diary record for the four-week representative period, receipts for asset purchases, and phone accounts. The amount of occupancy costs which can be claimed is dependent on the taxpayer’s indivdual circumstances. In the Commissioner’s view, in most cases, the apportionment of the total expense incurred on a floor area basis is the most appropriate method. Project perfectly embodies the vision of the revitalization of East New York- a place with affordable homes, healthcare, community-oriented retail, and space for work and recreation.

Furniture & Smart Office Design

This means that affected taxpayers will have to perform two separate calculations to work out their total 2020 deduction — one for the period 1 July 2019 to 29 February 2020 and one for the period 1 March 2020 to 30 June 2020. Governor Kathy Hochul today granted clemency to 13 individuals demonstrating remorse, exemplifying rehabilitation, and displaying a commitment to improving themselves and their communities. Is one of those once in a lifetime projects and Apex is extremely proud to be a part of it. This project allows Apex to continue to fulfill its mission of creating quality affordable housing while also creating an environment where people of East New York can live healthy and happy lives."

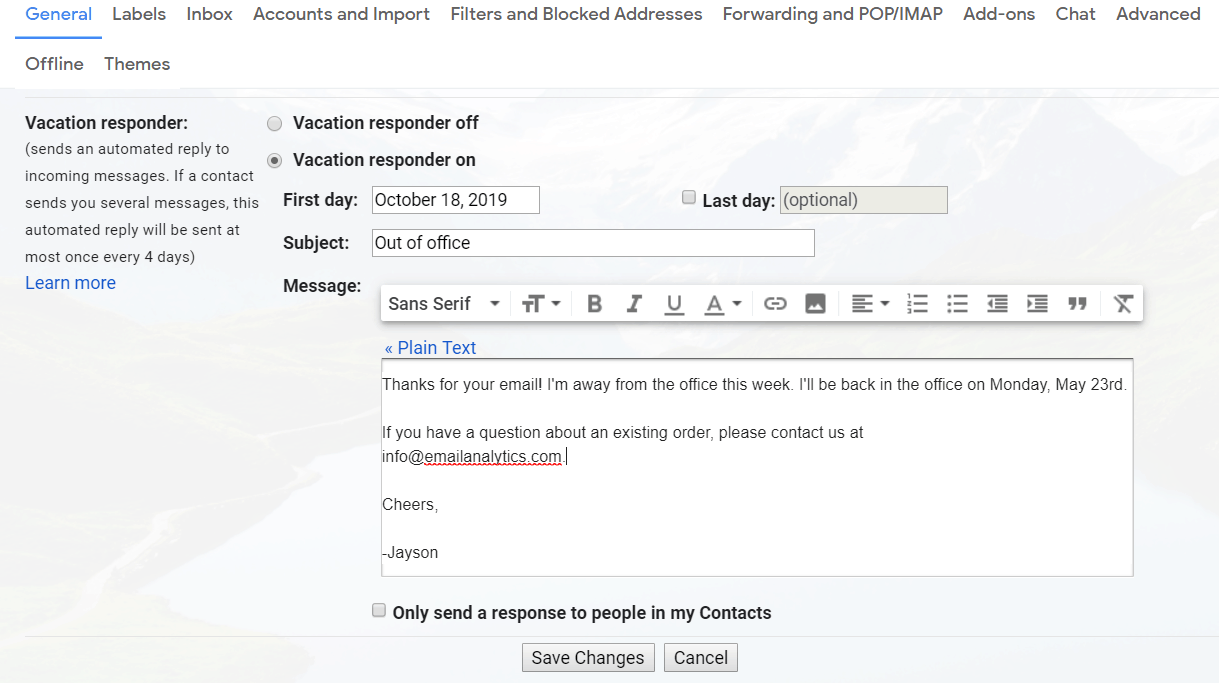

You can choose to use either of the other methods if they better suit your circumstances. If you opt to use this method, you can’t make separate claims for any additional expenses incurred while working at home. Shortcut method - claim a rate of 80 cents per work hour for all additional running expenses. If you choose to use this method, there is no requirement to separately calculate the decline in value of equipment or depreciating assets or any other working from home expense. Ephrem is an employee and as a result of COVID-19 he is working from his home office. In order to work from home, Ephrem purchases a computer on 15 March 2020 for $1,299.

How to Calculate Home Office Expenses and Depreciation

Central Brooklyn is also affected by wide economic disparities due to unemployment, high poverty levels, and inadequate access to high quality health care. Said, "There are few times in life that a project comes along that can help transform a neighborhood and the lives of the people in the community. Residents will have access to free high-speed broadband connection and 24/7 security services. Additional residential amenities will include laundry rooms, bike rooms, and recreational spaces.

He is married to a U.S. citizen and is a caretaker to his mother and mother-in-law, both of whom are also U.S. citizens. He moved to the United States as a child and has lived here for more than 30 years. Mr. Shaaban was convicted of Attempted Criminal Sale of a Controlled Substance in the Third Degree in 2008. A pardon will help Mr. Shaaban remain in the United States with his family.

Running expenses

Commitment to expanding economic opportunity for all New Yorkers through strategic investments in affordable housing. Made possible through the Vital Brooklyn Initiative, the redevelopment of the Brooklyn Developmental Center will revitalize Central Brooklyn by building a healthy, affordable, and vibrant community for generations to come." The retail space is expected to house five commercial tenants with the goal of attracting neighborhood-serving local small businesses.

A pardon will help him avoid deportation and remain in the United States with his family. Franklin Barcacel, 54, has lived a crime free life for 23 years and is an active member of his local community, volunteering for translation and food distribution programs at local community centers and actively participating in his local church. Mr. Barcacel moved to the United States as a child, has lived here for more than 40 years, and has five children and a grandchild who are all U.S. citizens or Lawful Permanent Residents. Mr. Barcacel was convicted of Criminal Possession of Stolen Property in the Fourth Degree and Tampering With Witness in the Second Degree in 1999. Allowable home office expenses include your rent, mortgage interest—although not the principal part of your mortgage payments—property tax, renter's or homeowner's insurance, homeowners association fees, utilities, and repairs.

Claiming expenses for working from home during COVID-19

He intends to use the shortcut rate to claim his additional running expenses. He and his wife operate two small businesses in the Bronx and are active members of their local church community. Mr. Paulino Castro was convicted of Attempted Criminal Possession of a Controlled Substance in the Third Degree in 2005. He has lived in the United States for more than 20 years, and a pardon would help him avoid deportation and remain here with his family. "We are not just building housing for the people of East New York, we're investing in a community so that generations of New Yorkers can flourish and thrive," Governor Hochul said.

You would apply your percentage rate to each of these expenses, then tally them up to arrive at your deduction. You can't deduct more than your net business profit after claiming other work-related deductions. For example, you're limited to a $2,000 deduction if your office expenses work out to be $3,000, but you only made $2,000.

Computers, software programs, and office furniture are all good examples. The ATO has updated the hourly rate for calculating home office running expenses for the income year commencing 1 July 2018. Claims for occupancy expenses are allowed only if the home is used as a place of business and the claim can be made as an apportionment of total expenses incurred on a floor area basis.

In fact, the final intelligence threat assessment three days before the riot did warn of a violent scenario in which “Congress itself” could be attacked by armed Trump supporters. But the warning was buried towards the end of the 15-page document and was not included in the up-front summary, so was overlooked. Nor was the warning mentioned in three subsequent daily intelligence reports.

While this is considered a running expense, not all categories can claim home office deductions for depreciation. Work-related expenses has beena key focus areafor the Tax Office, with the first individuals not in business tax gap report revealing a $8.7 billion gap, driven primarily by work-related expenses. For example, a couple living together could each individually claim the 80 cents per hour rate.

Lesly Parfait, 52, has lived a crime free life for 17 years and is employed as a concrete worker. He is active in his local union and has volunteered to teach construction skills to youth in his community. He is married to a U.S. citizen and has two children, four stepchildren, and seven grandchildren, all of whom are U.S. citizens. He is the primary earner and important source of support for his family. He came to the United States at age 5 and has lived here for more than 45 years.

The IRS introduced a second, much simpler method of calculating your home office deduction beginning in tax year 2013. This doesn't necessarily mean that you can't serve clients elsewhere, however. You just have to manage your business from your home office rather than at any other location.

No comments:

Post a Comment